Hi, this is Technologytodaynow. There’s something that Apple has never done before and Samsung has done so far. That’s Apple’s off-season first-quarter earnings. But recently, we got some amazing news that Apple broke its all-time record and took the top spot in the market.

Apple Achieves No. 1 in Q1 Performance

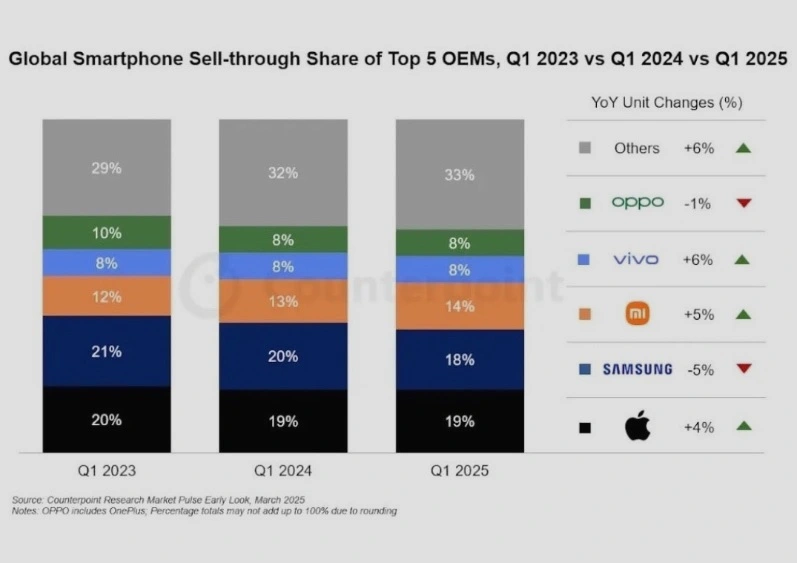

According to Counterpoint Research, Apple grew by 4% in the first quarter to take first place with a global smartphone market share of 19%. On the other hand, Samsung fell by 5% to take first place with a market share of 18%. Apple has been showing a pattern of taking first place in the fourth quarter when new iPhones are released, then dropping to second place in the first quarter, and then gradually decreasing in sales. However, as it has overcome these limitations, some are evaluating this as a signal of a change in the market landscape that is overcoming Apple’s seasonal and strategic limitations.

iPhone 16e Contributes to Increased Apple Sales Rate

What’s more surprising is that the iPhone 16e played a big role in this. Regardless of the harsh criticism, it became the number one contributor by increasing sales. This is a record that the previous iPhone SE series has not achieved, indicating that the iPhone 16’s launch was significant.

Apple iPhone Average Unit Price

In fact, the iPhone 16e’s effect can be seen from its high sales in India, the Middle East, Africa, and Southeast Asia, although Apple did not achieve remarkable results in the U.S., Europe, and China in the first quarter. Considering that global smartphone sales rose 3% to 304.9 million units in the first quarter, Apple is surprised by a higher record than the market’s growth.

But what’s even more surprising is Apple’s iPhone average selling price. It has increased significantly every year from $700 in 2017 to a whopping $903 last year. While Samsung is still below $300, from $250 in 2017 to $299 last year, Apple is significantly increasing its profitability with an ASP that is more than three times higher. With this, it is monopolizing nearly half of the profits of the entire smartphone market, taking 45% of sales with a 19% market share.

Apple’s iPhone 16e Sales Increase Impact

However, some say that the iPhone 16e could eventually lead to a drop in ASP if sales in emerging markets increase. Surprisingly, Apple is building a stronger wall in premium markets. In the first quarter, a survey of thousands of U.S. teenagers showed that 88 percent of them would buy iPhones, 25 percent of whom would buy the iPhone 17 series, making them a solid customer base.

Samsung’s Challenges and Tasks

In addition to expanding the new consumer base that will allow the iPhone 16e to experience the Apple ecosystem, it is expected to secure both sales and profitability by serving as a stepping stone to the premium model over time. In the meantime, Samsung’s share has been declining every year and is being pushed out by Chinese manufacturers. This is because Xiaomi and Vivo are sweeping the mid- to low-end markets with 5 to 6 percent growth in cost-effective models that are much cheaper than Samsung. In fact, according to various market research institutes such as IDC and Counterpoint Research, the proportion of A-series among Samsung’s smartphone lineup has been gradually decreasing over the past few years.

However, concerns are growing over the sudden increase in purchasing power of consumers who were buying the A-series and the decline in sales due to the choice of a cheaper Chinese manufacturer rather than the Galaxy S-series. Of course, the S-series sales and the growing proportion of ultra models have been successful in improving profitability, but the backsliding of overall sales is a challenge to be solved. However, it is also worth remembering that other market research institutes, IDC and Omnia, tentatively estimate that Samsung is first in the first quarter and Apple is second, unlike Counterpoint Research. This is because there may be some variations depending on how the survey is conducted.

Conclusion

Nevertheless, it is significant that Apple recorded remarkable growth in the first quarter, the traditional off-season, and that Samsung’s mid- to low-end lineup showed a decline in sales. This is because it showed that there are iPhone consumers who open their wallets even when released with ridiculous specifications and prices, and that Samsung’s challenge remains to hold on to consumers who want to buy cheaper models if possible.

Attention is focusing on whether Apple will be able to rank No. 1 in all quarters without off-season with its brand power in emerging markets and strategies using new medium-sized models.

We should pay attention to what Samsung’s solution to securing sales volume is amid intensifying competition, and whether Apple’s brand power can overcome tariff issues.